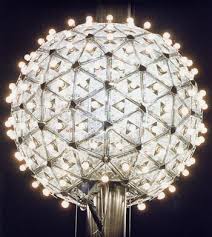

In just a few weeks we'll watch the ball drop at Times Square, ushering in 2011. And if you haven't taken advantage of your 2010 annual gift tax exclusion by then, you'll have dropped the ball! The gift tax exclusion can be an excellent tax planning planning tool. The exclusion does not carry over from year to year. So if you want to use it, not lose it, the time is now!

In just a few weeks we'll watch the ball drop at Times Square, ushering in 2011. And if you haven't taken advantage of your 2010 annual gift tax exclusion by then, you'll have dropped the ball! The gift tax exclusion can be an excellent tax planning planning tool. The exclusion does not carry over from year to year. So if you want to use it, not lose it, the time is now!The gift tax exclusion allows an individual to gift to any number of individuals, without any gift tax consequences, up to $13,000 per year. This can be an effective method for reducing the size of your taxable estate and minimizing or potentially even eliminating estate taxes. By way of illustration, if you have three children and four grandchildren. You can give each up to $13,000 in 2010 with no gift tax consequences. This would reduce the size of your estate by $91,000 ($13,000 x 7).

Also, the IRS allows you to gift without any tax consequences in any amount, provided your gift goes directly to an educational institution or medical provider. If you'd like to chip in for a grandchild's school tuition, you can do so in any amount, so long as the check is payable to the school.

More and more it's looking like Congress is not going to take action on the estate tax before the end of the year. That means that at the stroke of 12 midnight on Dec. 31, the federal estate tax will reset back to its year 2000 level, with a top tax rate of 55% on anything over $1million. Using your federal gift tax exclusion could soften the impact of estate taxes or even eliminate them. Plus, it'll make a darned nice present for your loved ones. For more information on gifting and estate taxes, log onto The Karp Law Firm website, and feel free to contact us at 800-893-9911.

No comments:

Post a Comment